DISCLOSURE: This post may contain affiliate links, meaning when you click the links and make a purchase, we receive a commission. Also an Amazon Associate, I earn from qualifying purchases. DISCLAIMER: The information and opinions within this content are for information purposes only. Guidance is based on personal interpretations and in no way, represents legal or financial advice. For more information, read my disclosure policy.

I knew I had a clunky budget system, but I didn’t know of any viable alternatives. Are you having trouble making your budget work in real life too?

For the last few years, I’d heard about the software called You Need a Budget (YNAB) and two years ago, I decided to give it a try. It was a lot of work to set up, but once it was running, it was incredible!

I felt like someone had created a tool to help me do what I’d been trying to do on my own, but it was SO MUCH BETTER!

A side effect of using YNAB was that it allowed my husband to be more involved with the budget. This has really helped relieve some stress about money management in our marriage.

Our previous homemade system was too complicated and I had to manage it all myself, making my husband like he had to ask permission to spend money. Is your current budget causing marital stress too?

Although I adore YNAB, it’s not perfect or free, so I decided to check out other options. Two major competitors to YNAB are Mint and Dave Ramsey’s Every Dollar. How do they stack up to YNAB?

Mint

Pros:

- Quick to set up.

- Great reports showing spending history

- Free credit score

- Easy-to-use net worth calculations

- Excellent goals calculators

- Free to use

Cons:

- Budgeting is not zero-based

- Makes it too easy to just track spending after-the-fact instead of planning ahead with a real budget

- Lacks customer support

- Nothing is really free and Mint is paid for by plenty of advertising for credit cards, investments, and other financial products

Every Dollar

Pros:

- Very simple to set up

- Free for basic version

- Paid version offers connection with banks for drag-and-drop categorizing of transactions

- Keeps track of your progress on Dave Ramsey’s baby steps (if you’re following that program)

- Looks very similar to the budget forms from Financial Peace University

Cons:

- Lacks any support for account registers so another tracking method is needed to keep track of bank accounts

- Can’t work on budgets for future months (only current month)

- Does not connect to American Express and some other banking institutions

- Very clunky to use for transaction entry with no memory of payees

- No way to easily move money from one budget to another

- Paid version is expensive at $99/year

- Advertises Dave Ramsey’s network of local providers

YNAB (You Need A Budget)

Pros:

- Robust account register system including recurring transactions

- Automatic matching of manual entries with bank import

- Easy bank account reconciliation to make sure your budget matches reality

- Works seamlessly with credit cards and almost all banking institutions

- Budgeting goals are flexible and helpful for tracking long-term progress

- Category tracking features allow you to see average spent in each category

- Quick budget options make monthly budget set-up easy

- Allows multiple budgets on one account (for example, home and business)

- Mobile app has GPS capabilities so it remembers your favorite stores’ locations and saves time on the transaction entry

- Extensive support available including live online classes, videos, message boards, and an excellent support staff

- Completely ad-free

Cons:

- There is no free version after the 34-day trial period – cost is $6.99/month, billed annually as $83.99/year.

- Does not do as good of a job at calculating debt payoffs and other goals as Mint

- Requires more effort and involvement than Mint (but I think that’s actually a good thing)

- Has it’s own “budgeting philosophy” which can be a little hard to adjust to if you’re coming from a different system like Dave Ramsey’s plan (but the two are compatible with each other)

YNAB now offers a referral program, but I’ve been spreading the news about YNAB for a long time because I just believe it’s that good.

Now if you subscribe to YNAB through my link, both you can get a free month of YNAB! Go now to sign up for the free YNAB trial through my link.

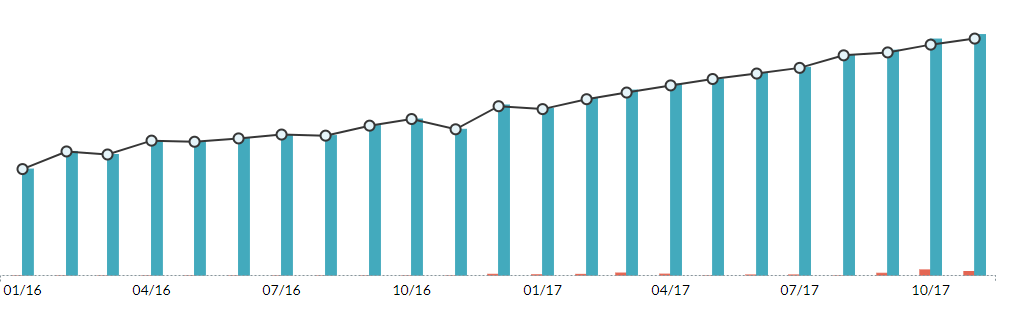

Need convincing that YNAB works? Here’s a chart of the amount of money in our bank and investment accounts over the last 2 years while we’ve used YNAB:

Our net worth while using YNAB

I left the $ numbers off of the chart, but you can see that the change has been very significant. It’s certainly more than $83.99/year!

Bottom Line: Mint vs Every Dollar vs YNAB

I think it’s pretty obvious that I’m still a huge fan of YNAB and don’t plan on switching my budgeting software. I will leave my account open with Mint, though, as I found the reports interesting as a way to look at my overall financial picture.

Every Dollar has almost nothing going for it compared to the other two. I think the only reason Every Dollar has any popularity is that it has Dave Ramsey’s name on it.

If you want free and easy, Mint has a lot of great tools. If you want robust, fully-featured budgeting software, YNAB is the way to go.

For someone just beginning to budget for the first time, I’d recommend starting by signing up for a Mint account and playing around with the reports.

If you use your debit or credit card for most purchases, it’ll be easy to get an idea of where your money is being spent every month. You can also get an overall picture of your debts and total net worth.

Next, I’d take that information about your spending habits and use it as a starting point for a budget in YNAB. Once you get through setting it up and understanding how it works, YNAB makes everyday budgeting a breeze.

It’s so easy and fun that I often find myself wishing I had more things I could play around with in YNAB! Don’t believe me? Give it a try and you’ll see! Use my referral link to get a free month of extra month of YNAB through my link.

Do you use these tools? Did I miss any pros and cons? Comment below!

Casey Tevis

Sunday 19th of May 2019

I’m glad I found your article. I’ve used Mint and now I’m in my first FULL month of YNAB (I didn’t give a it a chance before and was always going back to Mint). I love how I can give every dollar of my paycheck a job and how even though a bank-to-bank transfer hasn’t completely hit one bank or another I can see the growing talley of the savings account. I like knowing how much of the $160 I set aside for groceries I have for the second week so I don’t go over.

Cindy Scott

Sunday 19th of May 2019

I am glad you are enjoying YNAB! It has definitely been with it to my family!

Charles K Gardin Jr

Friday 18th of January 2019

Sister Cindy,

Hi! My name is Charles from Alamogordo NM. I am a retired 28 year vet of the of the US Air Force and am currently working on a ministry degree. I love to help people … that is my calling.

I have a YNAB question (I am not tech savvy). How does the software help me budget. For example, if I make a purchase at my local Walmart, is the software able to divide/separate my purchases i.e., groceries from clothing items etc. or will I have to do that manually myself? Thank you in advance and God bless!

Charles

Cindy Scott

Friday 18th of January 2019

Hi Charles, thanks for the question. YNAB is simply a tool for YOU to track your money and make decisions about what you want to use it for. You have to be actively involved.

For your example if a Walmart transaction, you would need to enter it into the app and tell it which categories that transaction comes from. Those categories can be whatever make sense to you. Some people might have a "general shopping" category that covers all of the Walmart items. Others may choose to separate it into groceries, toiletries, household products, pet food, etc.

I hope that helps! Definitely go check out the YNAB articles and videos if you want to see more.

nancy mclain

Friday 25th of May 2018

i really got used to Finance Works app and now my credit union has switched , do you know of something similar to the Finance Works app? thanks for any comments , i dont really want to pay an annual fee to keep track of my money.

Cindy

Friday 25th of May 2018

I am sorry that I am not familiar with Finance Works. I understand not wanting to pay an annual fee, but maybe give YNAB a try. You may find it is life-changing!

Ricard Torres @ Escaping to Freedom

Monday 19th of September 2016

Thanks for the comparison, Cindy!

I'm also a big fan of YNAB and how nice it is to use, especially for anyone who's never had a budget. I'm using version 4, which is a one-off payment, but there's also the web app version, which is newer and a recurring payment - that was a little disappointing, as I expected the newer version to be free for their current customers... Oh well!

Cindy

Monday 19th of September 2016

Yeah, it's unfortunate that the new web version is a subscription service, but I understand that YNAB needs to have a sustainable business model if they're going to keep producing such awesome software and educational materials. I feel like paying for it is supporting a worthy cause. Personally, I purchased version 4 last fall, a few months before the release of the web version, so I did get a free year of the new web version. I switched over in January and I think it's a wonderful system.

FinanciaLibre

Monday 12th of September 2016

Awesome overview of these tools, Cindy - thank you!

I love how you distilled them all down to a few bullet-points. It's kind of tough to investigate software like this without actually giving it a try, but I feel like your review really puts it all into focus for a tech dunce like myself.

Nice work, and thank you!

Cindy

Monday 12th of September 2016

I'm glad you found it helpful. I know I always get overwhelmed by choices like these and I appreciate it when someone can simplify it. Thanks for stopping by!