DISCLOSURE: This post may contain affiliate links, meaning when you click the links and make a purchase, we receive a commission. Also an Amazon Associate, I earn from qualifying purchases. DISCLAIMER: The information and opinions within this content are for information purposes only. Guidance is based on personal interpretations and in no way, represents legal or financial advice. For more information, read my disclosure policy.

Are you looking for a way to boost your budget and save some money quickly? Maybe you’d like to pay off a debt or save up for a purchase. A no spend challenge is a great way to do that!

What is a no-spend challenge?

A no-spend challenge is a way for you to set up rules for yourself to take a break from spending money. The time period and rules are personal to you.

The goal of a no-spend challenge is to save money by cutting spending temporarily. Read below for simple steps for doing your own no-spend challenge.

1. Make a Goal for your no spend challenge

What is your “why” for doing a no spend challenge? Using your reason to set a goal is a great way to start. Some ideas for a goal for your no spend challenge include:

- Jump start a new budget

- Build up your sinking funds

- Pay off a debt

- Save up for something (Christmas, vacation, a new sofa, etc)

- Correct some bad habits (like too much shopping or eating out)

Whatever your goal for your no-spend challenge is, write your goal down and post it somewhere obvious (on the fridge, the door, the kitchen wall, etc).

2. Set up Your No Spend Challenge guidelines

Everyone’s no-spend challenge is a little different. There’s no one “right” way to do it. Your personal no spend challenge rules should include:

- How long is your challenge?

- What kind of spending is allowed?

- What type of spending is not allowed?

- How will you handle unexpected things that come up?

Different Lengths of No-Spend Challenges

- Weekend: a good way to test the waters and to help curb entertainment spending.

- Workweek: great for breaking workday spending habits like coffee and lunches out.

- Week: a do-able way to look at all types of spending habits.

- Month: good for making a larger impact on your budget.

- Year: usually done with just one or two categories, like no clothing or home decor spending for a year.

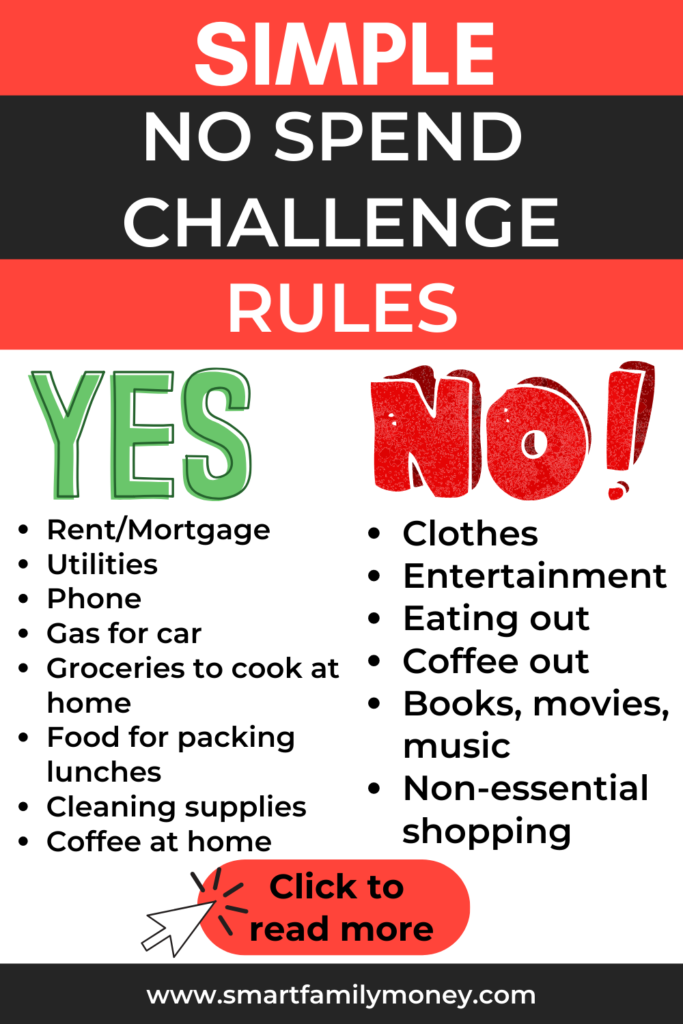

Spending rules

You can set your spending rules to whatever works for you, but here are some ideas of what others have done.

Spending that you probably WILL allow:

- Household bills: mortgage/rent, electricity bill, water bill, etc

- Basic food: unless you have a well-stocked fridge & pantry, you may want to allow grocery shopping

- Gas for the car: you will have to decide if you want to allow spending on gas for commuting (or switch to biking or walking to work instead) and if buying gas for entertainment is allowed.

Spending that you will likely NOT allow:

- Dining out

- Entertainment expenses

- Clothes shopping

- Coffee out

- Any non-essential shopping

Handling the Unexpected

If I’ve learned anything from my years of budgeting, it’s that you always need to plan for the unexpected. Discuss with your spouse or an accountability partner how you will handle various scenarios.

What are you going to do if something doesn’t go according to plan? Think about:

- How will you handle any invitations from friends? Politely decline or suggest a free alternative like hanging out at your place?

- What will you do if you see something you want to buy? I suggest writing it down to consider after the challenge has ended.

- How will you handle something breaking or getting lost? If your only work shoes get a hole in them or you lose your sunglasses, what will you do? I’d suggest planning to discuss any kind of spending that you want to do that falls outside your allowed categories.

3. Prepare for Success with your no spending challenge

This is a critical step! If you don’t prepare yourself to succeed, you’re just going to end up frustrated and more likely to quit your challenge before the end. Here are some things that consider:

What Is Your Plan for Food?

- Do you already have an overflowing freezer and pantry that you will eat from?

- Will you grocery shop before your challenge to prepare?

- Is any eating out allowed on your plan? If so, what would be the least expensive way to do that?

- Do you have a meal plan in place?

What Does Your Calendar Look Like?

- Do you have some busy evenings you need easy meals for?

- Any special events like parties or weddings to attend?

- Do you have too much free time with kids that will need to be filled with some free entertainment?

- Will your work schedule or kids’ activity schedule affect your spending or require some pre-planning?

- What’s the weather looking like? Will it affect your spending or plans?

- Check local community calendars for free entertainment ideas like festivals, free concerts, or library events.

What Substitutions Do You Need to Prepare For?

- If you’re going to pack your lunch for the first time, do you need a lunch bag? Or sandwich supplies?

- For homemade coffee, do you need a coffee maker (here’s my favorite) or a travel mug? (Check out: ways to save money on coffee)

4. Use Your No Spend Challenge Time Well

Not spending money can not only open up some space in your budget, but it can also open up time for other things. Use your time during your no-spend challenge well. Here are some suggestions:

- Spend (free) quality time with friends and family. Play a board game, play catch, invite friends over for iced tea on the patio.

- Explore your community. Visit a park, check out a community center, go to the library, or walk around your neighborhood.

- Help someone or do something nice. Rake your elderly neighbors leaves or bake some cookies for a friend.

- Clean or organize your home. That messy closet is calling your name!

- Get some exercise. Walk, run, bike, swim, or play tag!

- Sell something. Add a little more money towards your goal by selling something you don’t need. (See: what to sell today from around your house)

- Use up any gift cards or free coupons you have. Do you have any gift cards laying around that you been meaning to use? Just be careful to use only the gift card and not spend more.

5. Evaluate Your No Spend Challenge experience

I think this is the most important step to a no-spend challenge! Evaluate how it went. Here are some things to consider:

- Which new habits would you like to make permanent?

- What unexpected things came up?

- What’s on your list of desired items? Do you still want to buy them or has the feeling passed?

- How much money were you able to save? Did you reach your goal?

- What did you think of your guidelines? Would you change something next time?

- When would you like to do another no spend challenge? Would you do a longer one next time?

Don’t Forget to Put the Money Toward Your Goal!

Make a payment on your debt or put your money aside for Christmas or buy the thing you were saving up for. Whatever your goal was, make some progress!

Also, congratulate yourself! Even if things didn’t go exactly as planned, you tried something new, made some progress, and learned something.

Way to go!